Price Trend Line = Houses v Units

The graphs above represent a trend line of the median price performance at capital city level. Source = Cotality. Note the above graphs don’t represent ‘prices’ but show ‘price changes’ over time.

Houses – Perth continued to lead house price growth in the period ending 31 January 2026, recording a solid 1.9 percent increase for the month. Darwin also delivered a strong result at 1.6 percent but remember this is a market that is only around 6-7% of the size of Perth [Perth = 1M dwellings - Darwin 70,000 dwellings]. Brisbane and Adelaide posted healthy gains of 1.5 percent and 1.3 percent respectively. Canberra recorded a more moderate rise of 0.5 percent, with Hobart lifting by 0.4 percent. Sydney and Melbourne remained more subdued, each edging higher by 0.3 percent and 0.2 percent. Overall, all capital cities remained in positive territory, with momentum continuing to favour markets where affordability, population growth, and constrained supply remain supportive.

Units – Unit values delivered stronger results in several markets in the period ending 31 January 2026, with Perth leading the way at 2.3 percent growth. Brisbane followed closely with a 2.0 percent increase, reinforcing the ongoing strength in more affordable unit markets. Darwin and Hobart also recorded solid gains of 1.4 percent and 1.0 percent respectively, while Adelaide posted a moderate rise of 0.8 percent. Sydney saw a modest increase of 0.2 percent, while Melbourne and Canberra recorded slight declines of 0.2 percent and 0.1 percent. The divergence between markets highlights continued demand for well-located, affordable unit stock, particularly in cities where housing affordability pressures remain elevated.

FORECAST - During January, competition for well-located, quality property was as strong as we’ve seen, while overpriced homes or those with irreversible issues (busy roads, flood zones, next door to electrical sub stations) continued to struggle. The latest interest rate increase isn’t welcome news, but on-the-ground conditions remain far more resilient than many forecasts suggest.

At this stage, the rate increase is unlikely to materially change overall market direction. Its impact will be felt more in slower or marginal markets, where buyers may gain leverage and sellers may need to adjust expectations. In stronger markets, demand remains well ahead of supply, and competition is unlikely to ease without further rate rises.

For buyers, if it is personally the right time for you to buy and the property is well chosen, there’s no evidence to support waiting for broad price falls. Supply remains tight, and the gap between good property and poor-quality stock is widening. As always, strategy, selectivity, and disciplined pricing matter more than timing the market.

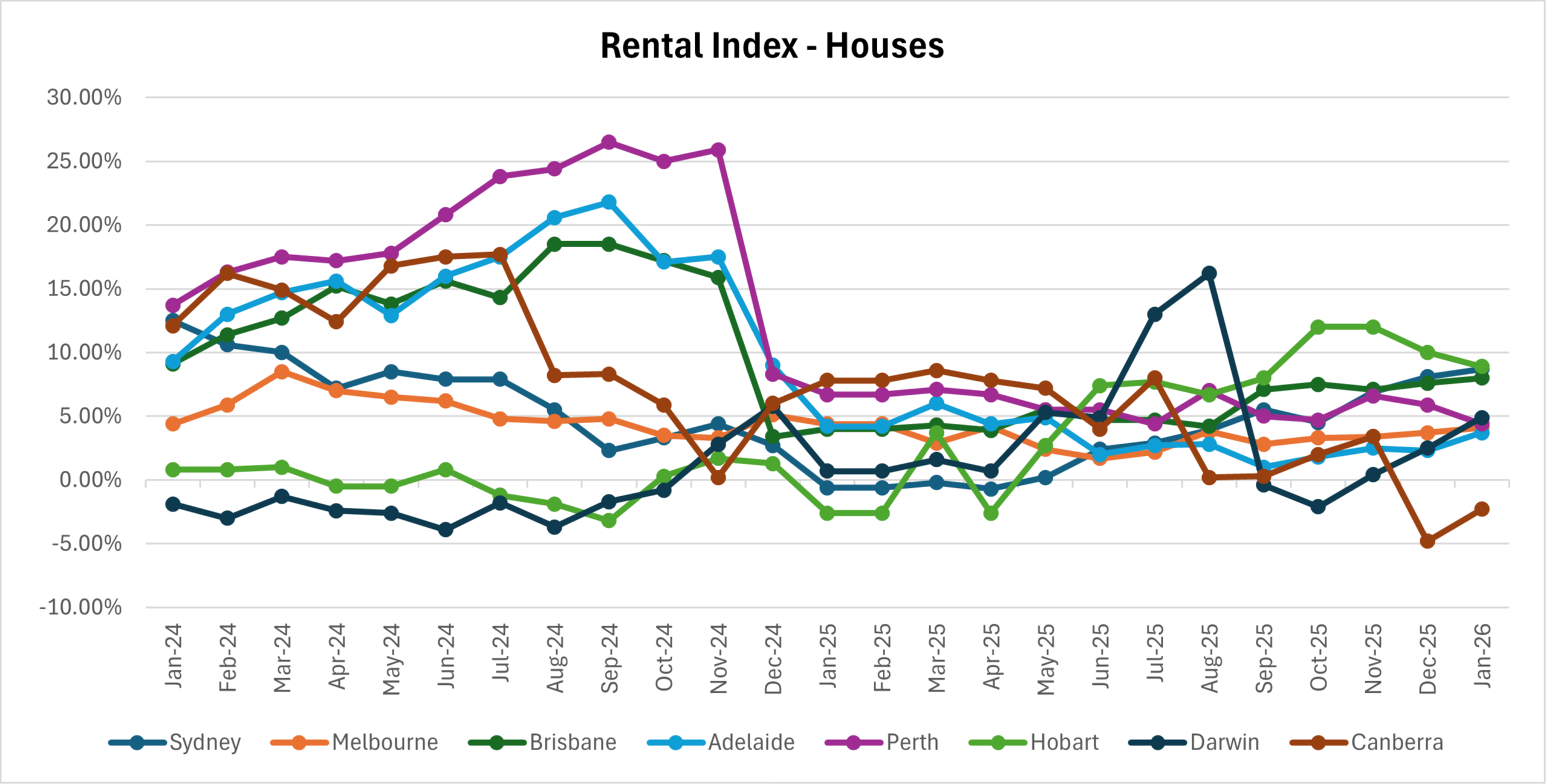

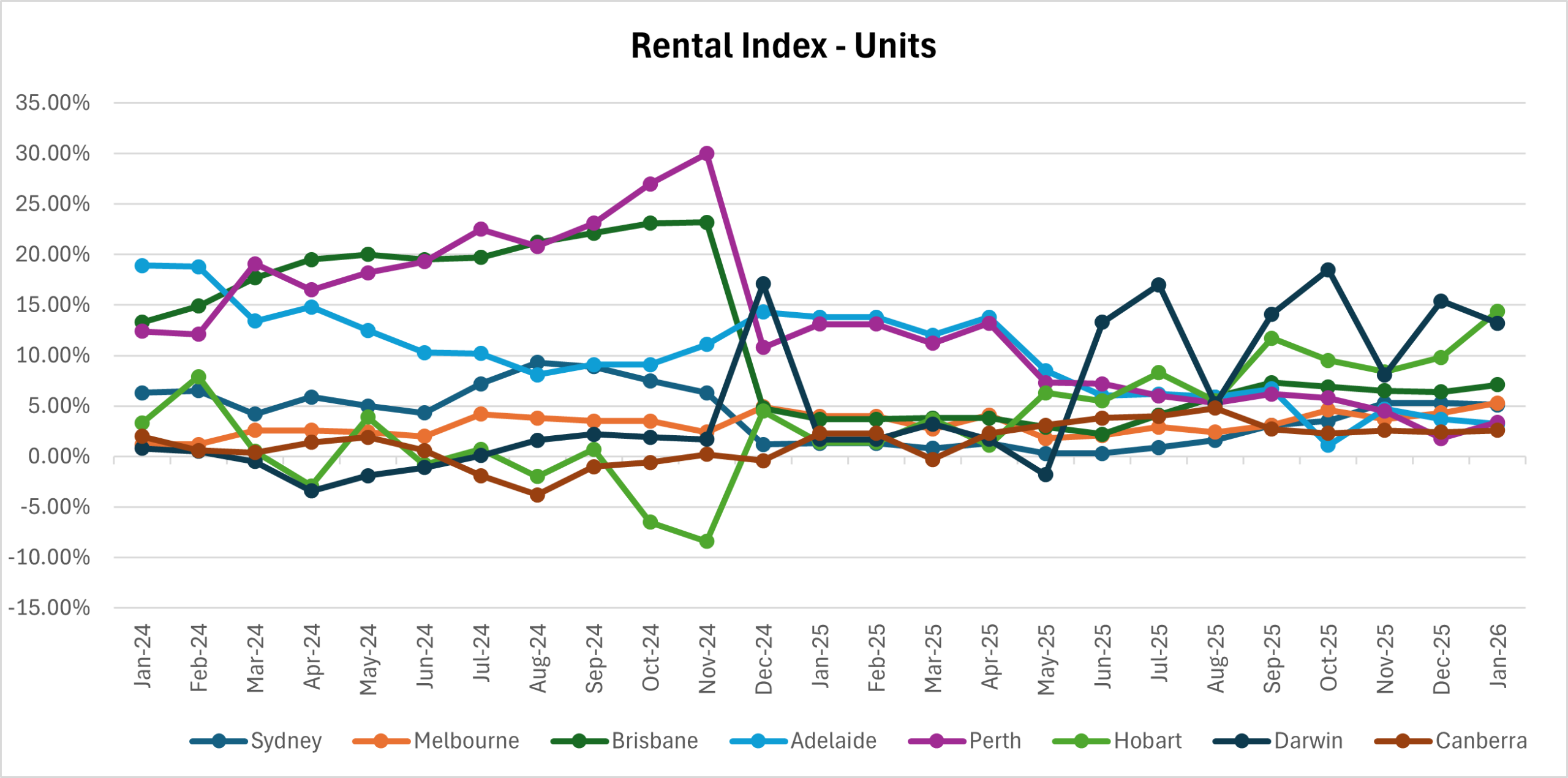

Rents - Houses v Units

Once again, please note the graphs below show ‘price changes’ not actual pricing [ eg – even though Darwin looks to be ‘on top’ this means it’s increasing faster than other locations, not that it’s more expensive.] Overall rents look to be stabilising, with very minimal change over the past couple of months.

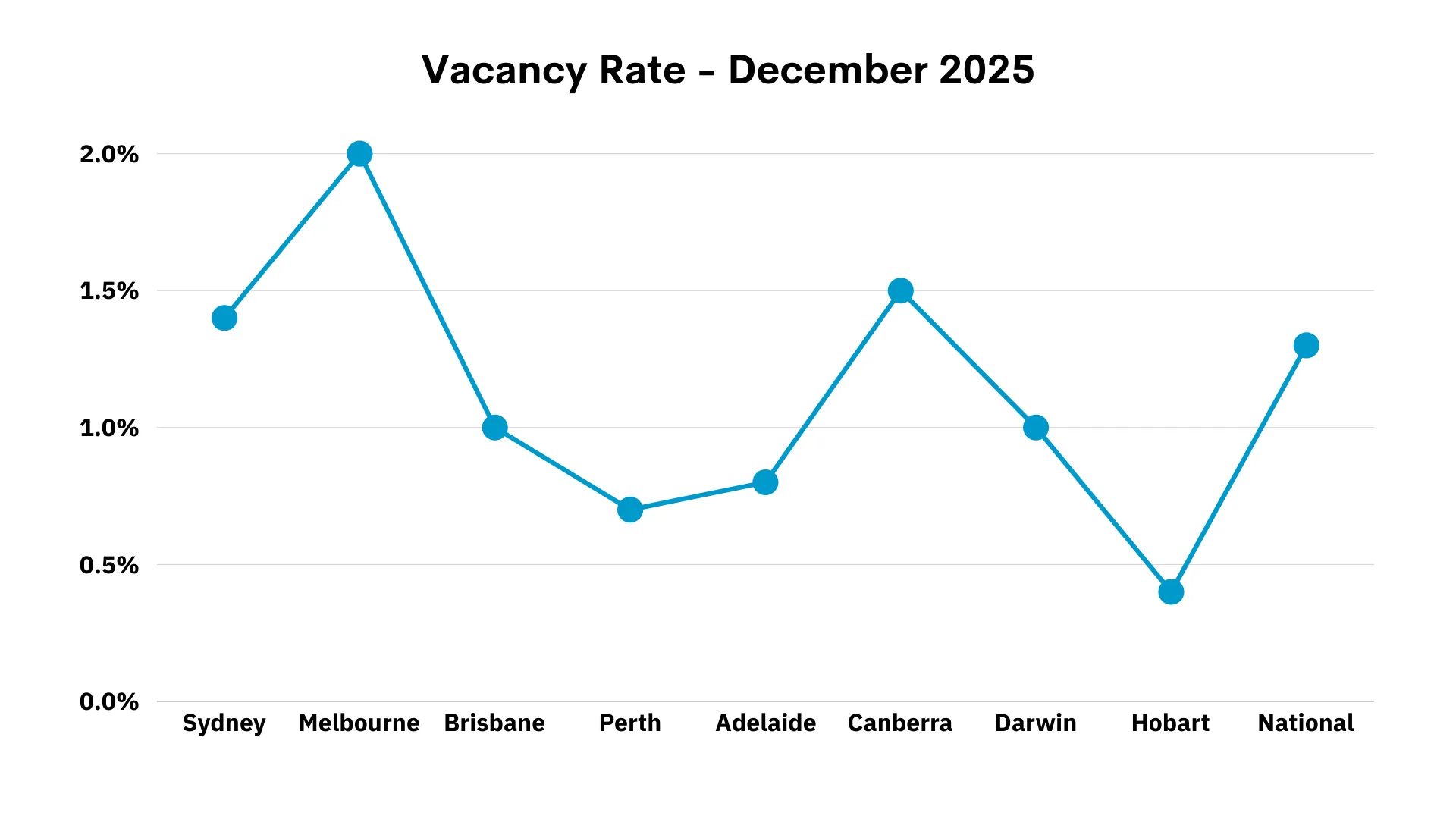

Vacancy Rate

This data is drawn from SQM Research. It represents the total vacancy rate in each major city. A ‘healthy’ rate is around 2.5%. Anything below this means the amount of properties available for rent is not sufficient to meet the amount of people who want to rent in that particular area. As you can see, all areas of Australia need more rental properties (all areas are under 2%), although supply is getting closer to healthier levels in Melbourne and Canberra.

Employment

Employment levels are an important indicator of economic health, and something the RBA monitors closely when deciding what to do with interest rates. This information should also be monitored by property buyers as a leading indicator of locations to avoid or consider for their next purchase.

The sweet spot for a good level of unemployment – where there’s enough jobs for those who want them - will hover between 4 and 5% depending on the rate of jobs turning over.

Anything below 4% would be considered to be low unemployment and would suggest a strong jobs market, attracting workers which increases demand for housing and pushes capital growth and rental returns upwards.

Anything in the 4.5% and upwards would reflect high unemployment which will indicate economic struggles, leading to weaker property price growth and eventually declines.

| New South Wales | 4.00% |

| Victoria | 4.70% |

| Queensland | 4.10% |

| South Australia | 4.00% |

| Western Australia | 4.30% |

| Tasmania | 4.20% |

| Northern Territory | 4.50% |

| Australian Capital Territory | 4.30% |

| Australia | 4.20% |

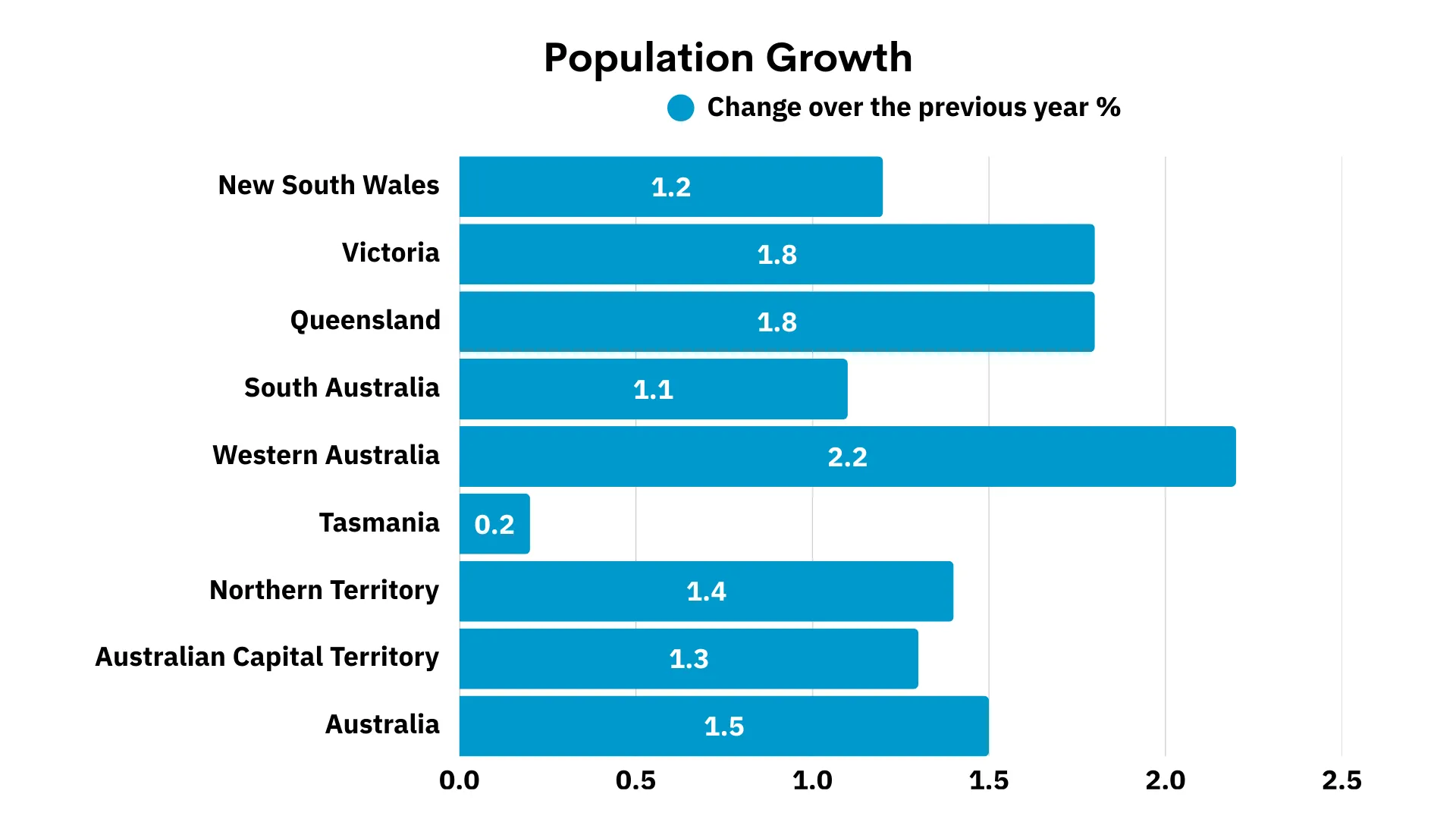

Population Growth

This graph shows the change in population by State over the last reporting period. The data includes changes caused by both overseas migration and also where Australians are moving from one state to the other. Overall Australia had 306,000 migrant arrivals in 2024 -2025, a slight decrease over the previous 2023-2024 year of 400,000.

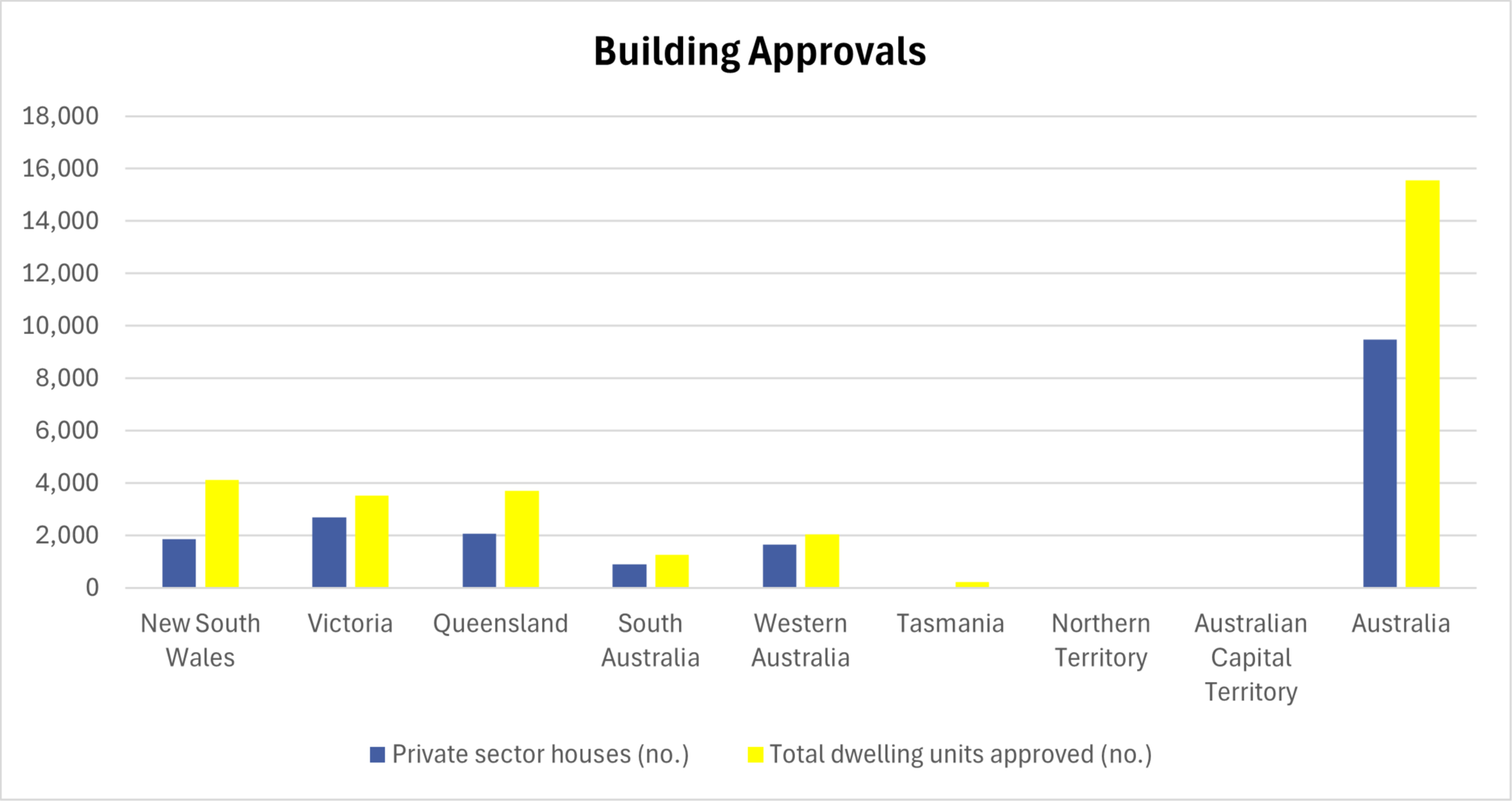

Building Approvals

The graphs below show the monthly dwellings approved in each State and Australia-wide, and also the percentage change. In 2024, the Australian Federal Government announced a target of delivering 1,200,000 homes by 2029 and to achieve this we need to build 240,000 dwellings (houses and units) per year. As you can see, we’re falling drastically behind on this target.

RBA Cash Rate (Interest Rate)

3.60%

Australian Dollar

1 AUD = 0.70 USD

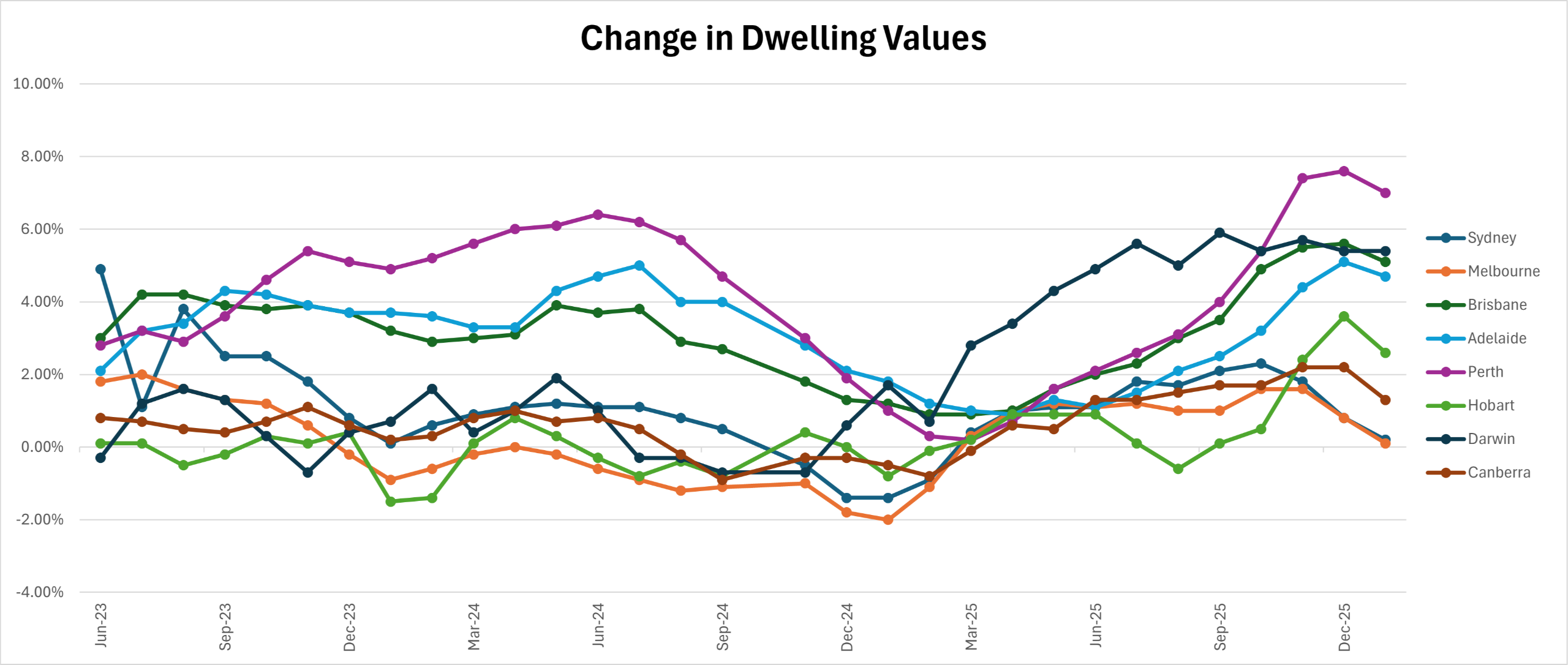

Dwelling Values Trend Line

The graph above shows the price trend line for houses and units combined. While this information is useful, it’s important to remember to look at pricing at suburb level and review pricing for your specific property type in order to identify opportunities and know what price to offer for your next purchase.

It was another solid month for dwelling values across most capitals, with Perth maintaining its lead at 2.0 percent growth. Brisbane followed with a strong 1.6 percent increase, while Darwin continued its upward momentum, recording a 1.5 percent rise (once again, a reminder that Darwin represents only around 6-7% of the size of the Perth or Brisbane markets). Adelaide posted healthy growth of 1.2 percent, reinforcing the strength of mid-sized markets. Hobart saw a more modest lift of 0.5 percent, while Canberra recorded a 0.3 percent increase. Sydney and Melbourne remained comparatively subdued, edging higher by 0.2 percent and 0.1 percent respectively. The broadly positive results reflect ongoing demand and tight stock levels, with performance continuing to favour markets offering relative affordability and stronger population-driven demand.

Of course, in order to be successful, where you buy depends on your personal requirements as well as what’s happening in the market so book in for a Property Clarity Chat if you would like more tailored, personal recommendations.

If you’re looking for a more detailed review of the market, check out the information below.

In this Market Watch 2026 episode, Debra and Scott break down January 2026 property data across all major capitals, showing where growth is strongest and where to be cautious. They unpack how interest rates, rents, infrastructure and government policy are reshaping the market. You’ll also hear what’s really happening on the ground across the Australian property market. In addition, this episode includes the most popular strategies for 2026 to leverage into your dream home, from units and rentvesting to renovation and duplex projects.

DETAILS FOR THE PROPERTY SMART START As mentioned in this episode - The Property Smart Start is a live two-part workshop focused on how smart buyers make great decisions before buying property. At the end of the session, you'll leave with your own Property Buying Map knowing how to assess opportunities against your goal and what to focus on next, so each step of your search makes it easier to buy your target property. Details and registration = https://www.propertyfrontline.com.au/property-smart-start-2026

CONTACT SCOTT OR DEB

Contact Scott - message him on (m) 0406070005 or / https://www.facebook.com/scotthochgesang.propertycoach

Contact Deb - https://www.propertyfrontline.com.au/book_to_talk

How We Help

From strategy, through to assessment and purchase of your ideal property - we're here to make your property journey successful and stress-free.

We'll help you :

✅ know what and where to buy

✅ search, negotiate and acquire your property

✅ know what to do next.