Forecasting versus mud-slinging

Well 2024 has started and the usual games have begun. The game this month? Who can convince us they know where property prices are heading this year before it becomes blindingly obvious their claims are not based on fact and their intention is just to make noise. 😯

First a bit of background

You know the media feeds on clickbait so they need very dramatic headlines to win your attention every minute of every day. Property is one of Australia’s greatest loves so people who can come up with catchy lines in the property space get the media spotlight.

BUT . . here’s the thing most people don’t realise or just don’t want to admit. Everyone who makes a media comment has an agenda. Very few commentators have good intentions and publish balanced, unbiased stories . . . but most ‘experts’ have more selfish drivers – and ironically if they’re commenting on the property market they’re often not real property experts.

On the 2024 horizon

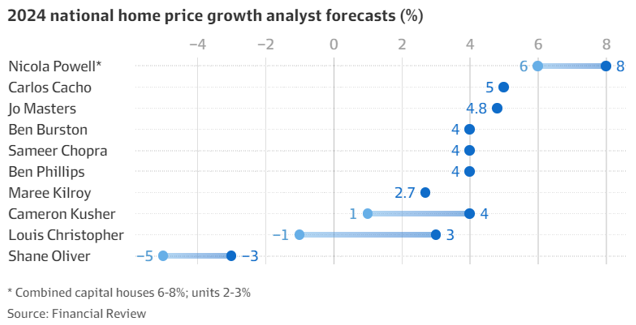

So let’s take a look at the forecasts for this year. Looking at the graph below we can see the estimates cover a broad spectrum. Everything from an increase in prices of up to 8%, right through to negative 5%.

Problem one

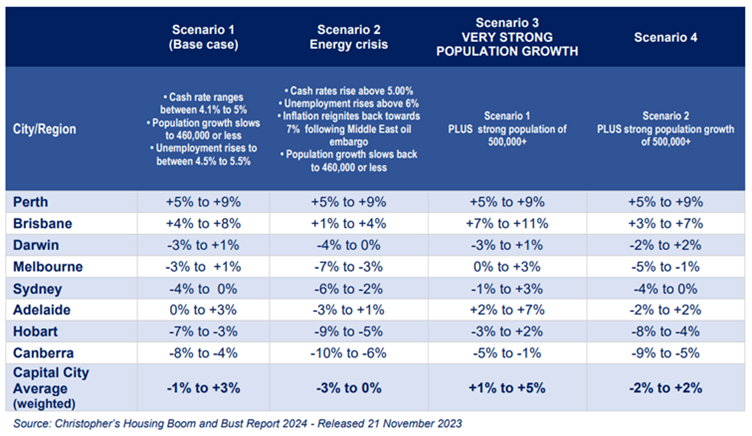

The first problem with these types of summaries which you will hear me talk about a lot – is that the numbers / forecast is meaningless when considered at ‘national’ level as shown in the graph above. To really understand what is happening within the market, you need to have a closer look at suburb level information as some areas are shooting ahead and pricing for other areas is plummeting. The big dichotomy this year . . Brisbane v Hobart . .Brisbane is leaping while Hobart is tanking (Darwin and Canberra are also big tankers this year).

Problem two

The second issue is the basis of the forecast. Most commentators weirdly base their forecasts on previous sales performance and don’t consider the extensive range of influences on market performance.

For example – one of the biggest reasons most forecasts were wrong for 2023 is that the massive increase in migration wasn’t considered as a market influence. None of the bank forecasters looked at the impact migration would have on the supply issue, and continued their old format of using interest rates as the main source of influence on prices. No wonder they were so far off on their predictions.

Problem three

The third key factor to think about when reading the forecasts is to look at who is actually making the forecast and consider their agenda. For example . . Nicola Powell is employed by Core Logic. It’s in CoreLogic’s interest for the market to be buoyant. They do also need to maintain their credibility so you could put some weight on Nicola’s forecast.

If you hear a forecast from a financial institution (bank or similar) economist, you should give the forecast a very wide berth. They have almost universally never made a correct forecast, they use outdated models to produce their forecasts and most have a commercial agenda requiring them to influence public thinking towards the organisation’s benefit.

A case in point is Shane Oliver – ‘economist’ from AMP Capital. In January 2023 Oliver claimed ‘property prices will drop 20 percent’ and this year he says prices will drop by 3-5%. Oliver is not a property expert, having spent his entire career in the shares and equities markets.

Also . . he’s employed by one of the country’s largest (and worst performing) super funds. So his employment is based on hyping the general public towards shares and other diminishing assets promoted by AMP.

However, as a spokesperson for a prominent financial brand, Oliver gets to spruik his case of drama to hopefully cause AMPs few remaining clients to stay the course. It’s astounding he can still get air time as the only time his property market predictions have been right is when the market has already changed and he can’t be drowned out because the data is showing what’s actually already happened.

Who do we believe?

If you’ve been following me for some time you will know the only forecast we take seriously is the Boom Bust Forecast by SQM Research. Louis Christopher pioneered the ‘phased scenario’ approach to forecasting and his annual forecasts have been consistently correct for more than six years in a row . .including last year.

See below for his forecast for 2024.

On the Frontline

While the forecasters can throw ballpark estimates about how the national market will perform, the action is very different on a property by property level. Market stock / properties available for purchase is at all time low levels, so you really need to be on your game to find, assess and purchase the best options.

Add into the mix that interest rates are expected to stabilise and we’re expecting to see competition for available properties to increase.

What does this mean for you?

The truth is the market has adjusted yet again, so if you want to buy property and you have your finance ready there’s no point ‘waiting for a better time’.

Ensure you stay true to the principles of buying property that meets your range of criteria (eg – do you want a renovation project or a property that doesn’t need any work), and always consider your exit strategy – ie – if you decide to sell will there be a good pool of buyers who want your property. . . what I’m really trying to say is avoid NRAS properties 😎 as they will never make you money.

About the Author

Debra Beck-Mewing is the CEO of The Property Frontline and Editor of Property Portfolio Magazine. With over 20 years of experience buying property across Australia, Debra is a skilled property strategist and buyers agent known for uncovering tailored opportunities — from family homes to multi-use investments.

She has deep expertise in advanced strategies including renovations, granny flats, sub-division, and development. A Qualified Property Investment Advisor (QPIA®), licensed real estate agent, and holder of a Bachelor of Commerce and Master of Business, Debra combines strategic insight with hands-on experience.

Debra is the creator of the Property Smart Track™ – Australia’s only interactive, in-the-moment support system for property buyers, designed to help buyers cut through the chaos and buy with confidence. She also leads Buy Like A Genius™, a premium end-to-end buyers’ agency service for busy professionals seeking expert property acquisition without the stress.

As a passionate advocate for greater transparency in the property and wealth industries, Debra is a sought-after speaker, author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Download your guide

Start Buying - Stop Crying

There’s plenty of opportunities if you’re trying to buy a property in the current market, and the news gets better if you qualify for financial assistance packages.

DON'T GUESS, STRESS OR OVERPAY

Learn how to turn the market in your favour no matter where it heads next, by using the tips included in our guide.

We hate SPAM. We will never sell your information, for any reason.