Are shares really better than property?

The old guard of the share market like to poke fun at property investors. They’re the people who fan the flames that property is over inflated – mostly because they don’t understand how to choose quality property, and also because they simply don’t want to ruin the foundations of their own financial stability.

They’re skilled in ‘talking the market up’.

But given the way the market has performed over the past few weeks, it’s hard not to see the share market as the original cryptocurrency. All it took was a couple of posts from a couple of people and the market – globally – dived and rolled. Shares are just ‘paper’ and hype after all.

The old guard – along with a lot of newcomers – leapt to the defence of ‘the market’ talking long and loud about how the market ‘always’ recovers and that the sensible thing is to ‘ride it out’.

Depending on where you draw the starting line, it can look like recent short-term pain in the share market pales in comparison to long-term gain, but do shares really trump property over the same time scale?

Outlined below is a real comparison of the 'shares v property' markets. Note that the technical components of this story came from a summary posted on realestate.com.au, but the sarcasm and 'commentary' is all me : - ).

Weakness in the share market throughout April sparked concerns among the millions of Australians with exposure to shares, particularly those people who saw their super fund balances dive dramatically.

During this period, Australia’s share market came close to recording a correction – the technical term for a decline of more than 10%.

It follows a larger downturn in the US triggered by investor worries about the impact of tariffs on the economy and increased recession risk amid an environment of stretched valuations, with the change in sentiment spreading to our local market.

Despite recent falls, the share market is up in the long term

While a 10% fall in the share market may seem alarming, it’s important to put recent falls into perspective.

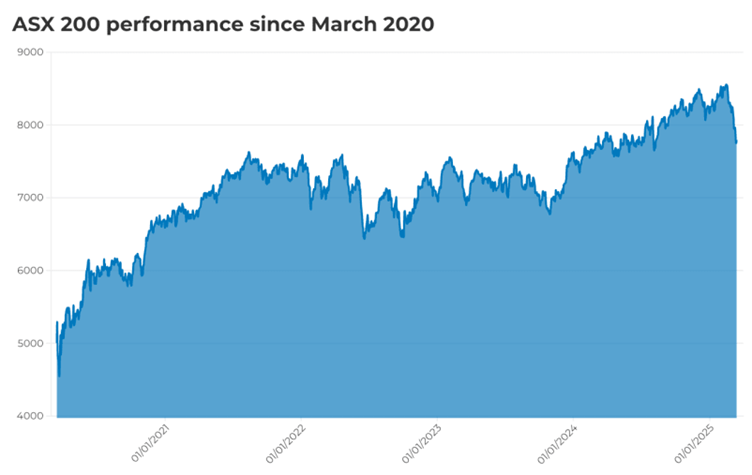

Five years ago, the ASX 200 recorded its largest one-day decline in more than 30 years, falling 9.7% on 16 March 2020 amid concerns over the economic impact of the pandemic, which had only just begun.

The market kept falling and hit a low on 23 March, the day nationwide lockdowns began, with the index crashing by about 30% from its previous all-time high.

But what followed that tumultuous period was a huge bull run which took the local market to its highest point ever in February this year. From trough to peak, the ASX 200 rose 88.2%.

Even after the recent dip, the ASX 200 is still up 71.4% compared to the low point five years ago.

Property prices have surged since the pandemic

Let’s compare that performance with the property market. At the national level, property prices are up 46.7% since March 2020, according to the latest PropTrack Home Price Index, but performance varies considerably around the country.

Adelaide has been the top-performing capital in that time, with the 81.7% growth in property prices putting the South Australian capital slightly ahead of Perth (81.2%) and Brisbane (80.9%). Prices in regional South Australia, Western Australia and Queensland performed similarly over that period.

Interstate migration, changes in lifestyle preferences and an imbalance of supply and demand in these markets have driven that huge growth, as has relative affordability – as interest rates rose, buyers with diminished borrowing capacities sought out less expensive homes.

Over a similar period, prices are up 38.6% in Sydney, 35.4% in Canberra, 37.1% in Hobart and 30.4% in Darwin.

Melbourne remains the outlier among the capitals, recording property price growth of a meagre 15% since the pandemic.

That underperformance is attributed to a range of factors including tougher lockdowns during the pandemic, migration flows to other states, higher levels of home construction relative to population growth, a weaker economy and tax changes.

Shares are ahead of property, but it’s not that simple

At face value, it could seem that the share market has outperformed the property market at the national level and in the largest capitals in the past five years, even after the weakness of recent weeks.

However, that conclusion overlooks several key factors.

It should firstly be noted that achieving that 71.4% return from the share market would require an investor to buy at the very bottom of the market in March 2020 – exceptional timing and something that would have taken a great deal of conviction at a time of extreme volatility when many investors were fearfully selling off stocks.

An investor who had bought in about a month earlier — when the market had just hit an all-time high — and held on through the crash and subsequent recovery would be looking at a return of just 8.6%.

Further, most property buyers use leverage — that is, people borrow money from a lender to buy a home or investment, typically 80% of the value of the property value — which can amplify gains.

For example, if an investor bought a $500,000 property using a $100,000 deposit and a $400,000 loan and that property rose in value by 46.7% (the same rate that the national median value grew), they would be sitting on a $233,500 gain, excluding any interest, expenses or rental income.

On the other hand, leverage in the share market, also known as margin lending, is less common and the risks are greater, considering the fact that even small declines in the market can lead to large losses.

An investor using margin lending is required to maintain a certain amount of equity in their account to cover potential losses. If the account balance falls below the required margin, investors will be required to deposit additional funds to meet the margin requirement, or will be forced to liquidate their position.

The same isn’t true in the property market. If the value of a home falls below the loan balance, known as negative equity, lenders don’t require homeowners to contribute additional funds or sell their home. Interestingly, according to the RBA, very few loans are in negative equity.

Of course, if property owners can’t keep up the repayments on their mortgage – even if the property has increased in value since the purchase - then the bank could take action although owners are usually given considerable opportunities to postpone payments, and owners are often helped to get payments back on track.

Income versus expenses

A factor that skews the comparison between shares and property is dividends – the portion of a company’s profit it pays to shareholders. The dividend yield of the ASX 200 currently sits at about 3.5%, which is down from a long-term average of a little more than 4%.

Similarly, property investors who rent out their property accrue rental income. The gross rental yield at the national level is 4.4%, according to the latest REA Group Rental Report, with a higher yield for units (4.9%) than for houses (4%).

Gross rental yield does not take into account expenses, such as interest, strata payments and maintenance, which will be based on an investor’s personal situation and the property itself.

A key point to remember is that we’re still looking at a ‘helicopter’ view of comparisons – because if an owner is paying down their loan their rental returns will be much higher than 4%, and if they have additional income – from a granny flat or second dwelling – then the returns can be higher.

Liquidity

The other way that shares and property differ is liquidity – the ease with which an asset can be converted to cash. Shares can be bought or sold online at the click of a button, whereas trading property typically takes weeks or months, has higher transaction costs and requires the service of professionals, such as real estate agents and conveyancers.

Properties typically cost hundreds of thousands, or millions of dollars, while shares can be traded in parcels as small as $500. A property ties up a lot of capital and concentrates risk in a single asset, with no guarantee performance would precisely track its broader market. On the other hand, the same amount of money could be invested in a portfolio comprising a range of different shares or index funds that track the market, spreading risk across multiple assets.

A key piece of the liquidity puzzle is the tax advantage of owning a property compared to shares. Share traders will need to pay capital gains tax on profits, and the same is true for property investors. But for an owner-occupier, profit derived from selling one’s main residence is typically tax-free.

There’s more to property than profit

While data from the past five years may suggest that shares trump property, simply comparing performance ignores the fact that most people borrow to buy a home, whereas most retail investors don’t use leverage to buy shares.

It also overlooks the varied costs associated with owning a property, as well as the income generated from both shares and property.

Notably, this comparison highlights the potential volatility in the share market, with maximum returns requiring investors to enter and exit the market at very specific times, and on the flip side, the concentration of risk that comes with buying a property.

Property risk can be mitigated easily with good due diligence, with many properties buffered from market fluctuations if good selections are made. Property also offers owners a much higher level of control over the asset.

At the opposite end of the spectrum, the past few weeks have been a clear demonstration of how vulnerable the share market can be – with the markets see-sawing at the blink of a tweet or post from just a handful of people, offering share owners very little control and exposing the share market as the original cryptocurrency.

Setting aside comparisons on returns, control and volatility - one of the biggest advantages property has over shares is its utility. At its core, a property provides shelter, but it's also a tangible asset that can be personalised, renovated, knocked down and rebuilt entirely, or even rebuilt to turn one dwelling into multiples.

Turning one dwelling into many is valid for houses and units, as all levels of Government scramble to meet the dwelling demand of our expanding population.

What’s best for you?

Ultimately, each individual will have their own preferences and personal requirements, and will be drawn to one investment class over the other. The best advice used to be that you should have a mix of both shares and property, though this is no longer true.

When making the decision about which is best for you, just ensure you look at all aspects of the choices available.

Keen to discuss your property next steps? Book in for a Property Clarity Call here.

NOTE : The base of this story was first published in realestate.com.au. The story has been adapted and enhanced by the author.

About the Author

Debra Beck-Mewing is the CEO of The Property Frontline and Editor of Property Portfolio Magazine. With over 20 years of experience buying property across Australia, Debra is a skilled property strategist and buyers agent known for uncovering tailored opportunities — from family homes to multi-use investments.

She has deep expertise in advanced strategies including renovations, granny flats, sub-division, and development. A Qualified Property Investment Advisor (QPIA®), licensed real estate agent, and holder of a Bachelor of Commerce and Master of Business, Debra combines strategic insight with hands-on experience.

Debra is the creator of the Property Smart Track™ – Australia’s only interactive, in-the-moment support system for property buyers, designed to help buyers cut through the chaos and buy with confidence. She also leads Buy Like A Genius™, a premium end-to-end buyers’ agency service for busy professionals seeking expert property acquisition without the stress.

As a passionate advocate for greater transparency in the property and wealth industries, Debra is a sought-after speaker, author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Download your guide

Start Buying - Stop Crying

There’s plenty of opportunities if you’re trying to buy a property in the current market, and the news gets better if you qualify for financial assistance packages.

DON'T GUESS, STRESS OR OVERPAY

Learn how to turn the market in your favour no matter where it heads next, by using the tips included in our guide.

We hate SPAM. We will never sell your information, for any reason.