The Big Con of Property Depreciation

Why Property Depreciation Costs More Than You Think

If you’re buying property as an investment, your goal should be simple - achieve solid, sustainable returns. Yet every year, thousands of investors fall into the trap of chasing short-term ‘tax benefits’ that ultimately hold them back.

And one of the biggest traps is the big con of property depreciation.

The Big Con

For years, developers and property marketers have used the promise of depreciation to lure buyers into purchasing brand new properties - house and land packages, off-the-plan apartments, and ‘turnkey’ investments.

The message sounds appealing: “Buy new and you’ll save thousands on tax!”

Basically, depreciation refers to claiming a tax deduction for the decline in value of your property’s structure, fixtures, and fittings. It’s a legitimate tool, but one that’s often used as bait to sell overpriced properties.

Here’s what most buyers aren’t told:

- You pay a premium for new property. New builds are usually priced 10–20% higher than comparable established homes, which instantly eats into your equity.

- Depreciation doesn’t last forever. Those big deductions reduce each year, and if your income changes or you move into the property, they can vanish altogether.

- Depreciation focused properties lock you into a job. Ironically, buyers are enticed to purchase these types of properties as a pathway to early retirement, but these properties will crush you if you need to leave your job or take a work break.

- It’s not ‘free money.’ When you sell, the Australian Tax Office claws back the depreciation funds you’ve claimed, meaning you pay higher capital gains tax and often won’t make a profit at all when you sell.

- Future growth is often limited. Many new developments flood the market with similar stock, capping future price growth and making it harder to resell.

- Quality can be questionable. Thin margins and bulk construction mean many new properties have shorter lifespans and more maintenance costs down the track.

It’s not uncommon to see investors buy off-the-plan apartments or house + land properties that drop in value the moment they settle - sometimes by tens of thousands of dollars - wiping out any hyped ‘tax benefit’ within the first year.

Elements of Real Success

The key to genuine investment success hasn’t changed: focus on yield, capital growth, and potential to add value.

Yield delivers your ongoing cashflow through rent.

Capital growth builds your equity over time.

Potential gives you the ability to manufacture extra returns through smart improvements.

Together, these three levers determine how fast you can reach your goals and none of them rely on artificial tax offsets.

Successful investors focus on areas with clear demand, limited supply, and room to grow in both population and infrastructure. That’s where consistent rent increases and long-term capital gains come from - not from depreciation schedules.

Real Example: New vs Established Property

Let’s compare two properties, both priced at $850,000 - one a brand-new apartment in a large Sydney complex, the other an established home in a tightly held suburb.

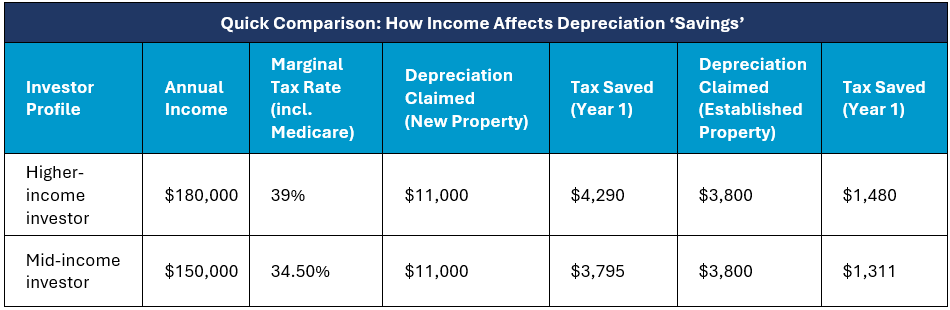

- The new apartment offers attractive depreciation in year one, giving a tax credit of around $11,000 for an investor earning approximately $180,000 per year. However, with hundreds of near-identical apartments nearby, rental growth is limited and resale competition is high. Average price growth for new apartments has been around 2% per year, so after two years the property might be worth $884,000 - barely enough to cover stamp duty and selling costs.

- The established home earns less in depreciation - around $3,800 - but sits in a suburb where family demand is strong, supply is limited, and land holds long-term value. Averaging 6% annual growth, it’s worth about $954,000 after two years - a gain of roughly $104,000 in equity, easily outperforming any tax benefit from depreciation.

The difference: Even for high-income investors, the “extra” depreciation benefit from buying new is only around $2,800–$3,000 per year.

The reality: In contrast, an established property growing at 6% annually delivers $70,000+ in equity within two years providing real wealth, not a paper deduction.

Real Example: Potential Pays

Now let’s look at potential.

The owner of the established property decides to add a secondary dwelling (granny flat) in year five using their built-up equity. Construction costs around $150,000, funded by the increase in equity in the property. The new dwelling adds $500 per week in rent and the combined property value rises by approximately $250,000, creating an instant $100,000 net gain and boosting total rental income by roughly 50%.

Meanwhile, the apartment investor has no such options. With no land to expand and strict strata bylaws restricting changes, the property’s future potential remains virtually zero.

The Smarter Way to Use Depreciation

Depreciation still has its place - particularly for investors who already own strong, established portfolios and want to offset legitimate costs. But it should be treated as a bonus, not the reason for buying.

When you focus on the fundamentals - growth, yield, and potential - depreciation becomes a helpful supplement and often a way to increase the supply of dwellings, not a crutch.

The Message

If your main motivation is saving tax, you’re not investing you’re just subsidising someone else’s profit.

By all means, claim what’s fair. But don’t let shiny marketing or spreadsheet promises blind you to what really matters. Choose quality assets in growth areas, understand how to measure true value, and remember: smart investors make their money when they buy, not when they claim.

About the Author

Debra Beck-Mewing is the CEO of The Property Frontline and Editor of Property Portfolio Magazine. With over 20 years of experience buying property across Australia, Debra is a skilled property strategist and buyers agent known for uncovering tailored opportunities — from family homes to multi-use investments.

She has deep expertise in advanced strategies including renovations, granny flats, sub-division, and development. A Qualified Property Investment Advisor (QPIA®), licensed real estate agent, and holder of a Bachelor of Commerce and Master of Business, Debra combines strategic insight with hands-on experience.

Debra is the creator of the Property Smart Track™ – Australia’s only interactive, in-the-moment support system for property buyers, designed to help buyers cut through the chaos and buy with confidence. She also leads Buy Like A Genius™, a premium end-to-end buyers’ agency service for busy professionals seeking expert property acquisition without the stress.

As a passionate advocate for greater transparency in the property and wealth industries, Debra is a sought-after speaker, author, podcast host, and participates on numerous committees including the Property Owners’ Association.

Download your guide

Start Buying - Stop Crying

There’s plenty of opportunities if you’re trying to buy a property in the current market, and the news gets better if you qualify for financial assistance packages.

DON'T GUESS, STRESS OR OVERPAY

Learn how to turn the market in your favour no matter where it heads next, by using the tips included in our guide.

We hate SPAM. We will never sell your information, for any reason.